Economy

Valentino, founder of Italian luxury empire, dies at 93

ROME — Italian fashion designer Valentino Garavani has died, his foundation said Monday. Usually known only by his first name,...

Read moreSaks files for bankruptcy as luxury market struggles

The company that owns the iconic luxury retailer Saks Fifth Avenue filed for bankruptcy late Tuesday. The move comes after...

Read moreWarner Bros. Discovery rejects Paramount’s amended takeover offer

Warner Bros. Discovery on Wednesday rejected Paramount Skydance’s amended takeover offer, the latest in a series of rejections in David...

Read moreTrump Media to merge with nuclear fusion company

Trump Media & Technology will merge with a fusion power company in an all-stock deal that the companies said Thursday...

Read moreShopify says a daylong Cyber Monday outage has been resolved

Outages on Shopify’s e-commerce platform have been resolved, the company said late Monday, bringing to an end a daylong glitch...

Read moreBarbie, Monopoly toymakers see bright holiday season despite tariff pressure

President Donald Trump’s tariffs are hitting toy giants Mattel and Hasbro as the critical holiday season nears. Still, both companies...

Read moreTarget is eliminating 1,800 corporate jobs as it looks to reclaim its lost luster

Target said Thursday that it is eliminating about 1,800 corporate positions in an effort to streamline decision-making and accelerate initiatives...

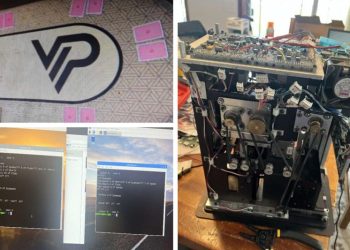

Read moreX-ray tables, hidden cameras: The tech in rigged poker games linked to the mob and NBA

Card-reading contact lenses, X-ray poker tables, trays of poker chips that read cards, hacked shuffling machines that predict hands. The...

Read moreTrump’s Argentina beef import plan will harm U.S. ranchers, industry warns

The American cattle ranching industry is blasting President Donald Trump’s proposal to purchase beef from Argentina in an effort to...

Read moreTravis Kelce part of investor group aiming to revive struggling Six Flags

A group that includes activist investor Jana Partners and NFL player Travis Kelce says it has accumulated one of the...

Read more